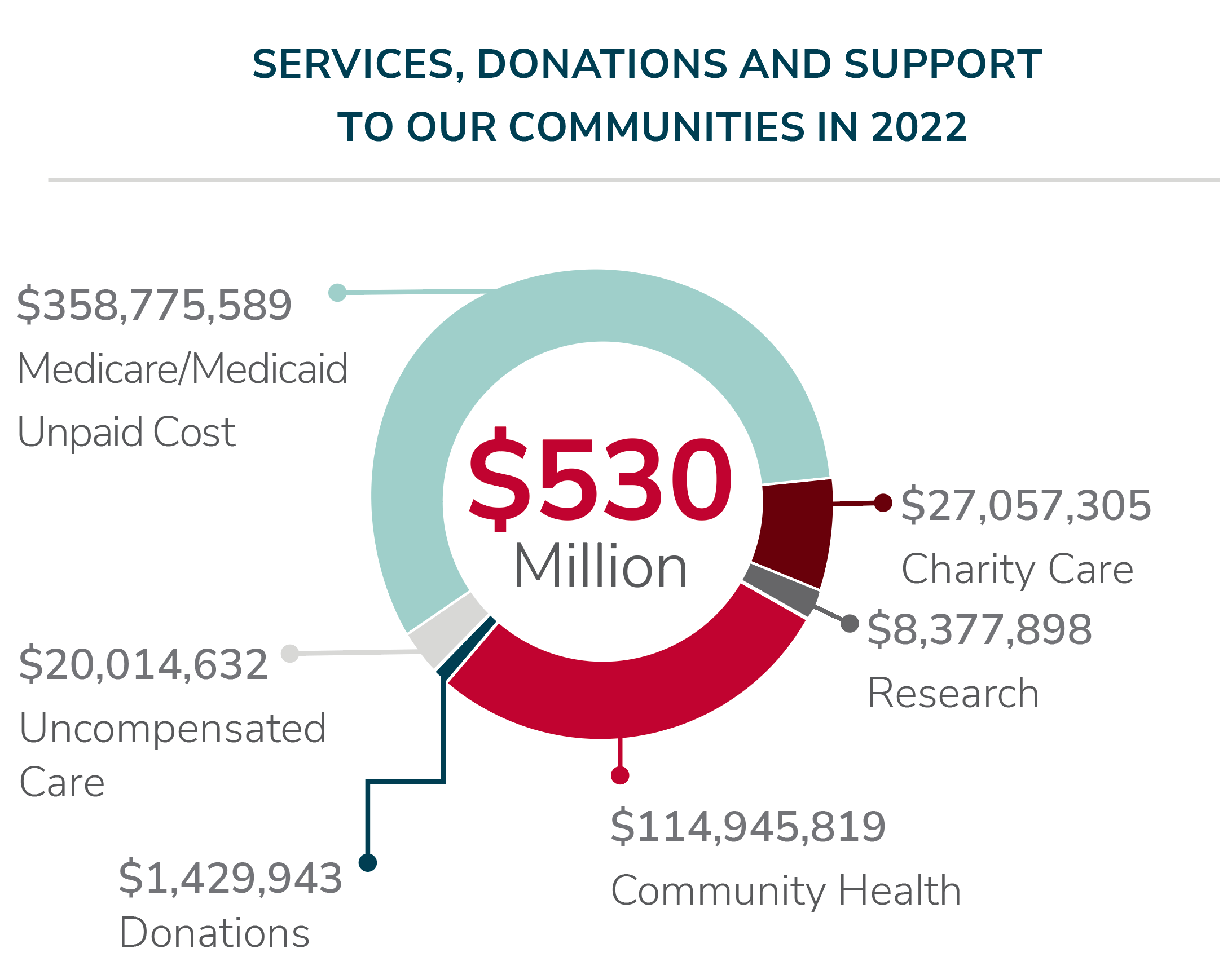

Community Impact

As the region’s trusted healthcare provider, serving and improving the health of our community members is central to everything we do at Carle. Our commitment to the community reflects our mission to serve by delivering world-class care, conducting impactful medical research and training the providers and caregivers of tomorrow. As part of our dedication to improving the health of the people we serve, we are constantly collaborating with other providers, research and teaching organizations, community organizations and policymakers to expand access to programs and resources to address issues affecting the health and well-being of our community members.